In preparing the Consolidated Non-Financial Statement, my thoughts first turn to the People and just how much we have all had to put up with this last year. The pandemic has made our lives very difficult indeed, forcing us to change habits and, in many cases, unfortunately, wiping out our certainties.

2020 was a year that was far from ordinary all the world over, in countless ways, and the banks were also struck by an emergency we could never have foreseen nor the effects of which we could possibly have forecast. The new social behaviour we have had to learn to adopt, at times going against our very nature, has impacted and will continue to impact in the future social, economic and financial dynamics.

As a Group, we responded swiftly, doing everything in our power to address the emergency. We promptly implemented smart working solutions and made key workstations safe for those needing to come into the office, right from the early weeks of lock-down, putting the health of everyone first. To protect our approximately 450 thousand Cooperative Shareholders and more than 2 million customers, we organised shifts and telephone or web-based appointments and consultancies, showing not only that we were able to stand close to our customers as a bank, even at a “distance”, but also an excellent capacity to react generally. All this would simply not have been possible without everyone’s commitment and hard work and I therefore feel the need here to personally thank each and every one of our 11,300 collaborators.

Once safety and business continuity had been guaranteed, we acted according to the new context. We arranged measures to provide a concrete response to the needs of our communities and opened up collaborative dialogue with the institutions. We implemented immediate support measures to have companies rapidly receive loans backed by the Central Guarantee Fund, as envisaged by government provisions. All the interventions and action taken are the direct result of the hard work of each of the Group’s Banks, with the support of Cassa Centrale and the Group’s companies. In concrete terms, we granted more than 110 thousand specific moratoria on mortgages granted to families and businesses, also envisaging credit facilities with dedicated ceilings and concessional terms. We often went beyond legislative provisions and category agreements and, with a great administrative effort, successfully considerably increased the plateau of beneficiaries.

The moratoria and intermediation of benefits went hand-in-hand with the structuring of a set of proposals on the “superbonus” that, with a careful approach paying close attention to specific territorial needs, allowed us to provide a new drive to the local economies. The very positive feedbacks collected allow us to declare that the Group is making a tangible contribution towards requalifying the national real estate heritage, paying close attention to the environment.

The pandemic has also helped promote remote tools in relations between customers and their bank. Inbank, our virtual banking platform, has reached 1.6 million users and an ever increasing frequency of use, also through the app available to our customers.

The highly-positive trend recorded in savings management is a tangible acknowledgement of the Group’s capacity to help its own customers.

We have been strongly committed to limiting the evident uncertainty and fear of the early months of the pandemic and, thanks to our continuous guidance, we have detected an important difference in approach between savers, in particular in asset management, which has allowed us to record good return performances during the year.

Growth was driven by sustainable segments, which rose by 48% (EUR 1.11 billion) on 2019, showing the growing interest, both by us and our customers, in social and environmental aspects.

In addition to our core banking activities, we have undertaken numerous solidarity initiatives in response to the specific needs of the territories. Of the total 14 thousand Group interventions, more than 9 thousand directly relate to managing the pandemic emergency, both through direct donations and fundraising for the supply of medical or basic materials.

As part of the solidarity moves connected with the pandemic, Cassa Centrale Banca – together with Allitude, Assicura and Claris Leasing – has decided to provide concrete help to new people in difficulty, donating EUR 1 million to Caritas (specifically supporting 9 diocesan Caritas branches, referring to the offices of the parent company and Group companies, and the national Caritas).

We are a Group that bears the strong hallmark of the values of mutual credit cooperation and our way of banking, today more than ever before, is a response to the needs of people and communities, combining deep roots in the territory with the efficiency and competitiveness of the products and services offered.

We have assigned yet greater importance to a crucial topic in today’s world and for the years to come: sustainability. In December 2020, we established the Board Committee designated to provide guidelines with respect to Sustainability and Identity, two aspects that our principles, values and characteristics see as very much intertwined. We want to optimise them all together, matching compliance obligations with cooperative interpretation that puts People and the relationship right at the heart.

In updating the strategic objectives in light of the pandemic, we have therefore considered sustainability as part of a journey that seeks to promote the cooperative values, which are the distinctive trait and “glue” holding the Cassa Centrale Group together. In this context, some initiatives that had already been launched were resumed, as recalled in the Statement, and will be implemented in the next Sustainability Plan, such as attention to People, the Environment and the Communities.

In this latter year, we have responded to the needs of our people and, at the same time, worked to improve the internal processes and respond ever more efficiently to compliance and risk management needs, preparing a wide range of structured, coordinated services for the Banks.

We continue to be firmly convinced that our model, with the BCC-CR-Raika holding the lead role in their territories, is necessary in order to guarantee the “biodiversity” that has always allowed cooperative credit to stand apart from the rest of the banking system.

Much has been done and we want to continue along this path and strengthen the preconditions so that the head and heart of the Group’s Banks can remain in the territories. Our specific cooperative nature is a distinctive, increasingly relevant added value.

Giorgio Fracalossi,

Chairman of Cassa Centrale Banca

"In this latter year, we have responded to the needs of our people and, at the same time, worked to improve the internal processes and respond ever more efficiently to compliance and risk management needs, preparing a wide range of structured, coordinated services for the Banks. We continue to be firmly convinced that our model, with the BCC-CR-Raika holding the lead role in their territories, is necessary in order to guarantee the “biodiversity” that has always allowed cooperative credit to stand apart from the rest of the banking system."

Giorgio Fracalossi, Chairman of Cassa Centrale Banca

The Group takes care of its Employees, in the firm belief that the creation of a healthy workplace hinged on listening and dialogue is essential to responsibly manage its business.

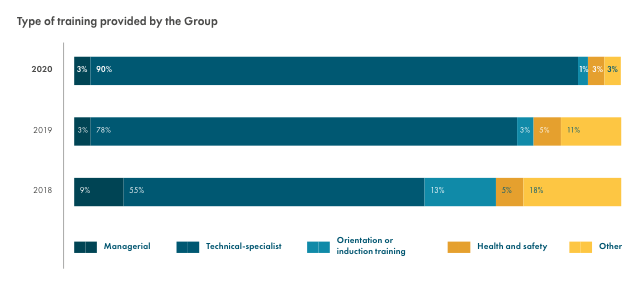

We enhance the potential of our People, constantly promoting training programmes.

This is why a total of 473,195 hours of training have been delivered on a Group level, making for an average of approximately 42 hours per Collaborator.

The Cassa Centrale Group offers its Collaborators a wide range of benefits, including:

- pension and supplementary health insurance – Pension Funds;

- additional insurance cover over and above the obligations set forth by the national collective bargaining agreement and specific for the Covid-19 risk;

- programme of subsidised loans and mortgages.

The Cassa Centrale Group believes that the protection of workers’ health and safety is essential in assuring continuous business growth.

In 2020, careful management of the workplaces, continuous communication and awareness-raising aimed at affording proper prevention, helped limit the number of injuries at work.

Cassa Centrale Banca and Allitude have received the “Safe Guard” certification, as a guarantee of the goodness of the actions taken and the overall management implemented in response to the Covid-19 pandemic..

Cassa Centrale Banca and Allitude have received the “Safe Guard” certification, as a guarantee of the goodness of the actions taken and the overall management implemented in response to the Covid-19 pandemic..

We undertake to offer products and services that coincide with the real needs of 2.3 million Customers, with clear, transparent conditions..

The loans disbursed by the Cassa Centrale Group in the favour of families, businesses, the third sector and the public administration as at 31 December 2020 amount to more than EUR 43 billion, for a total of 492 thousand beneficiaries..

for EUR 312 million

for EUR 16 billion

for EUR 16 billion

for EUR 11 billion

*number of beneficiaries

The Group aims to provide support to Cooperative Shareholders of affiliated Banks and the members of local communities in banking transactions and services, pursuing the improvement of their moral, cultural and economic conditions and promoting the development of cooperation, education to savings and welfare, as well as social cohesion and the responsible, sustainable growth of the territories in which the Group operates.

UNITED BY PRINCIPLES, INSPIRED BY VALUES

The Cooperative Credit Shareholders undertake on their honour to contribute to the Bank’s development, working intensely with it, promoting its spirit and commitment at the local Community and providing a clear example of democratic control, equality of rights, fairness and solidarity between the members of the social base. True to the spirit of the founding members, the Shareholders believe in and adhere to a code of ethics hinged on honesty, transparency, social responsibility and altruism.

[Art. 9 Charter of Values of Cooperative Credit - Shareholders]

Respect for and protection of the environment are key elements of the Group’s strategy and mission.

We take all steps necessary to reduce our impact and undertake to sensitise and raise awareness of such matters amongst all stakeholders, promoting environmentally-friendly actions and behaviour.

![]() More than EUR 1 billion invested in NEF Ethical, amongst the 34 funds worldwide to have received the Luxembourg Finance Labelling Agency certification for respect for environmental, social and governance (ESG) criteria in ethical finance.

More than EUR 1 billion invested in NEF Ethical, amongst the 34 funds worldwide to have received the Luxembourg Finance Labelling Agency certification for respect for environmental, social and governance (ESG) criteria in ethical finance.

![]() More than 1.6 million customers use the virtual banking platform Inbank, receiving bank documents in electronic format only: a service that in 2020 avoided the print-out of more than 79 million sheets of paper and the emission of more than 3,000 tonnes of CO2.

More than 1.6 million customers use the virtual banking platform Inbank, receiving bank documents in electronic format only: a service that in 2020 avoided the print-out of more than 79 million sheets of paper and the emission of more than 3,000 tonnes of CO2.

The Group’s ties to the communities in which it works are total and permanent. The mutuality and local approach, which are the very characteristics of cooperative credit, assure integration with the reference communities in ownership and operations, which make for a concrete interpretation of the social function.

Affiliated banks reinvest at least 70% of profits in an indivisible reserve, which benefits assets that in turn allow for the financing of development and the real economy. They pay 3% of profits into mutual funds for the promotion and development of the Cooperation.

![]()

SOCIAL/ASSISTANCE ACTIVITIES

![]()

CULTURE, TRAINING

AND RESEARCH

![]()

PROMOTION OF THE TERRITORY

AND ECONOMIC ENTITIES

![]()

SPORT, RECREATION

AND AGGREGATION

Letter from the Chairman (Italian Version) Download pdf

Sustainability Summary (Italian version) Download pdf

Consolidated Non-Financial statement 2020 Download pdf

Complete document archive Read more