Cooperative

by nature

Heirs to a history that has been a factor in the development of communities for over 100 years, we believe that it is possible to operate in a spirit of collaboration and solidarity, combining efficiency and cooperation, reciprocity and profitability, coordination and autonomy. Our status as a Cooperative Banking Group specifically reflects the principles of mutual credit co-operation and reinforces their implementation in our daily operations.

Partners to People and Communities

We want to bank as we have always done, in a way that is faithful to ourselves and to our history.

Our mission is to make a tangible contribution to the economic, social and cultural development of local Communities, promoting the well-being of our Customers, Shareholders and the Areas in which we operate. By leveraging the Banks’ local roots the and through constant dialogue and discussion with stakeholders, the Group’s structure creates the ideal conditions for operating in the best possible way in the service of the local Communities and Areas.

Cooperation, Reciprocity, Locally focussed: these have always been our principles.

We are a network of local, cooperative and mutual Banks, organised into a modern Banking Group.

It is a model that is self-sustaining and creates shared benefits, making the most of differences and local identity.

The Group contributes to the development of the economic, intellectual and social heritage of each country and Community in which it operates.

By means of donations and sponsorships, the Group also supports and promotes initiatives of a humanitarian, solidarity, cultural and sporting nature aimed at supporting and developing Communities.

OUR MODEL: BALANCING AUTONOMY AND COORDINATION

AUTONOMY AND VIRTUOSITY

We guarantee the Banks’ participation in the definition of strategies and objectives and a high degree of operational autonomy, the latter being determined by applying the principle of proportionality based on each bank’s state of health (risk-based approach).

GROWTH AND INNOVATION

We promote investments in innovation and technology, the dissemination of economic and financial knowledge to Customers and steps to make information processes as efficient as possible.

EFFICIENCY AND NIMBLENESS

Balanced governance is a cornerstone of the way we do business. In addition, Cassa Centrale Banca and its Subsidiaries provide Affiliated Banks with tools for the ongoing digitalisation of products and processes, as well as the implementation of partnerships for enhancing centres of excellence and best practices at a local level.

FINANCIAL STABILITY

The Cassa Centrale Group has a high financial strength, thanks to the high level of unencumbered intragroup assets, and it aims to maintain a CET1 ratio among the best in the national banking system.

RELATIONSHIP WITH THE COMMUNITY

Strong relations with local communities as well as investments to improve the economic, social and cultural environment are the tools the Group uses to meet the needs of its Shareholders and Customers.

Sustainable

from inception

We are a network of Banks formed by people who work for their Community.

Like those same people, our aim is to create wealth that we can pass on to the next generation. A goal that can only be achieved as part of a sustainable way of operating.

Our values

The values on which the Cooperative Credit is founded and which form the basis of our actions are fully consistent with the Sustainable Development Goals defined by UN Agenda 2030.

The charter of values of cooperative credit and agenda 2030

The Charter of Values of Cooperative Credit, issued in 1999, sets forth the values on which the activities of Cooperative Credit Banks are based, their strategy and their business practices; it contains the rules of conduct and reflects the commitments of the sector.

In this sense, the Charter of Values is the seal of the Pact between Cooperative Credit Banks and the local Communities and, through them, with the Country.

ART. 1- PRIMACY AND CENTRALITY OF THE INDIVIDUAL

The activities of Cooperative Credit are inspired by the attention to and promotion of the individual.

Cooperative Credit is a network of banks made up of people who work for people.

Cooperative Credit invests in human capital – consisting of shareholders, customers and partners – permanently enhancing it.

ART.2 – COMMITMENT

![]()

![]()

![]()

![]()

![]()

The commitment of Cooperative Credit focuses, in particular, on satisfying the financial needs of its shareholders and customers, seeking continuous improvement in the quality and value of the products and services offered.

The Cooperative Credit’s aim is to produce benefits and advantages, to create economic, social and cultural value for the benefit of its shareholders and the local community and to “build” trust.

The style of service, the in-depth knowledge of the local area, the excellence of the relationship with shareholders and customers, the supportive approach, and the attention paid to standards of professionalism are a constant motivation for those who manage Cooperative Credit banks and for those who work in them.

ART.3 – AUTONOMY

Autonomy is one of the fundamental principles of Cooperative Credit. This principle is vital and beneficial only if coordinated, connected and integrated into the Cooperative Credit “system”..

ART. 4 – PROMOTING INVOLVEMENT

![]()

![]()

![]()

![]()

Internally, Cooperative Credit promotes the involvement, in particular that of its shareholders, in the life of the cooperative.

Cooperative Credit promotes the involvement of local people in business life, favouring families and small enterprises; it promotes access to credit, and contributes to ensuring equal opportunities.

ART. 5 – COOPERATION

![]()

The cooperative style is the secret to success. The joining of forces, teamwork, and fair sharing of objectives is the future of Cooperative Credit. Cooperation between cooperative banks through local, regional, national and international structures is a condition for preserving their autonomy and improving their service to shareholders and customers.

ART. 6 – PURPOSE, SERVICE AND BENEFITS

![]()

![]()

![]()

Cooperative Credit is non profit-making.

The achievement of a fair outturn, and not the distribution of profit, is the goal that guides the management of Cooperative Credit. The operating profit is a means for pursuing the promotion of the well-being of the Shareholders and of the local areas served by Cooperative Credit.

It is also evidence of entrepreneurial capacity and a measure of organisational efficiency, as well as an essential condition for the self-financing and development of each cooperative bank.

Cooperative Credit will continue to allocate these profits to consolidate its reserves – to an extent at least equal to that required by law – and to other socially useful activities agreed by the Shareholders.

The accumulated capital is a precious asset to be preserved and defended out of respect for the founders and in the interests of future generations.

Cooperative Credit Shareholders may, in whatever way is most appropriate, obtain benefits proportional to the financial activity that they have individually carried out with their cooperative bank.

ART. 7 – PROMOTING LOCAL DEVELOPMENT

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Cooperative Credit is linked to the local community and expresses this by means of a lasting alliance for development.

It promotes the well-being of the local community and its economic, social and cultural development both through its lending activities and through the allocation each year of a portion of its operating profits. Cooperative Credit’s entrepreneurial activity is carried out in a way that is “socially responsible”, rather than being purely financially orientated, and in the pursuit of a fair economy.

ART.8 – ONGOING TRAINING

![]()

Cooperative Credit is committed to fostering the development of the skills and professionalism of its directors, managers and employees and the growth and dissemination of an economic, social and ethical culture among its shareholders and local communities.

ART.9 – SHAREHOLDERS

![]()

![]()

![]()

![]()

![]()

![]()

Cooperative Credit Shareholders undertake on their honour to contribute to the development of the bank by working intensively with it, promoting its spirit and commitment within the local community and setting a clear example of democratic control, equal rights, fairness and solidarity among the members of society.

True to the spirit of the founders, shareholders believe in and adhere to a code of ethics based on honesty, transparency, social responsibility and altruism.

ART. 10 – DIRECTORS

Cooperative Credit Directors undertake on their honour to participate in decision-making conscientiously and independently, to create economic and social value for the shareholders and the community, to devote the necessary time to this task, and to personally keep up their professional qualification and ongoing education.

ART. 11 – EMPLOYEES

Cooperative Credit Employees undertake on their honour to cultivate their inter-personal skills with a focus on recognising the individuality of each person and to devote intelligence, qualified commitment and time to their ongoing education and a cooperative spirit to the achievement of the financial and corporate objectives of the bank for which they work.

ART. 12 – YOUNG PEOPLE

Cooperative Credit believes in young people and endorses their active participation in its process of innovation. Through constant dialogue, it is committed to working with them, supporting them in the dissemination and implementation of cooperative credit principles.

The creation of economic value that is sustainable over time and for the benefit of the Local Area is one of our main objectives: it is an essential condition for redistributing the wealth generated among Shareholders, Customers, Employees and all stakeholders and for adequately supporting business investments and Community development.

Responsible

by vocation

We have always lived in the Communities and Local Areas in which we operate, alongside the people who live there.

We pursue the growth and well-being of our Communities through a sustainable way of operating and common values to be passed on to future generations.

PEOPLE

They are our most important asset: we take care of our Employees because we know that creating a healthy and positive working environment is one of the basic requirements for managing our business responsibly.

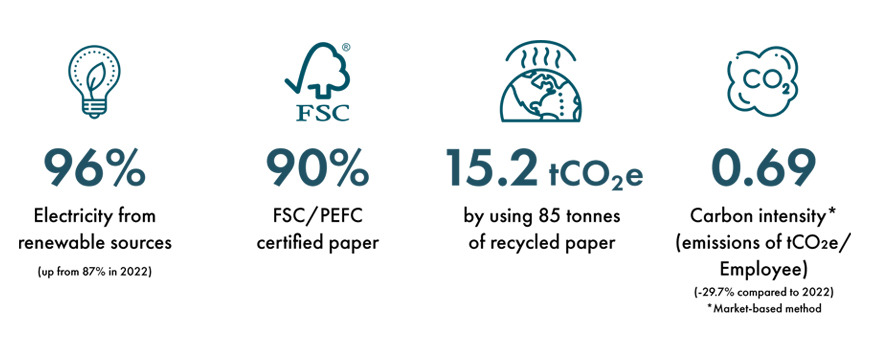

Environmental protection is one of the cornerstones of our strategy.

This is why we take all necessary measures to reduce our environmental impact and strive to raise awareness among all stakeholders, promoting environmentally friendly actions and behaviour that comply with applicable environmental regulations and laws.

Our commitment to promoting a responsible and sustainable culture also impacts our offering, with the implementation of specific commercial and training initiatives aimed at increasing Customers’ focus on investment instruments that integrate environmental, social and governance (ESG) criteria into financial products and processes.

What we are doing

FORUM FOR SUSTAINABLE FINANCE

Since 2019, we have been members of the Forum for Sustainable Finance, a non-profit, multi-stakeholder association comprising financial players and other stakeholders concerned by the environmental and social impact of financial activities

ETHICAL SUB-FUNDS WITHIN THE NEF FUND RANGE

The creation, within the range of NEF investment funds, of sub-funds consistent with the principles of sustainable and responsible finance

CASSA CENTRALE BANCA’S RETAIL ASSET MANAGEMENT

The start of a process aimed at progressively integrating sustainability and responsibility criteria into the financial instruments used within Cassa Centrale Banca’s Retail Asset Management

Il Gruppo Cassa Centrale vicino a Caritas Italiana

Uniti per contrastare le situazioni di disagio e fragilità.

Among other things, the Committee has the task of assisting the Board of Directors with preliminary proposal and advisory functions in relation to assessments and decisions concerning sustainability.

RISK AND SUSTAINABILITY COMMITTEE

With particular reference to the tasks related to sustainability, the Risk and Sustainability Committee supports the Board of Directors in relation to the following:

- identifying the Group's values and identity, also with a view to updating the Group's Code of Ethics, if necessary;

- identifying the guidelines and objectives of the Sustainability Plan in line with the Strategic Plan, as well as of the sustainability policies aimed at creating value over time in the medium/long term and considering the Group’s contribution to achieving the UN Sustainable Development Goals (2030 Agenda) and any subsequent international protocols and standards;

- periodically monitoring compliance with the sustainability plan objectives by the Group and each Associated Bank;

- assessing the impact of ESG issues on all stakeholders and the appropriate interaction and dialogue with them;

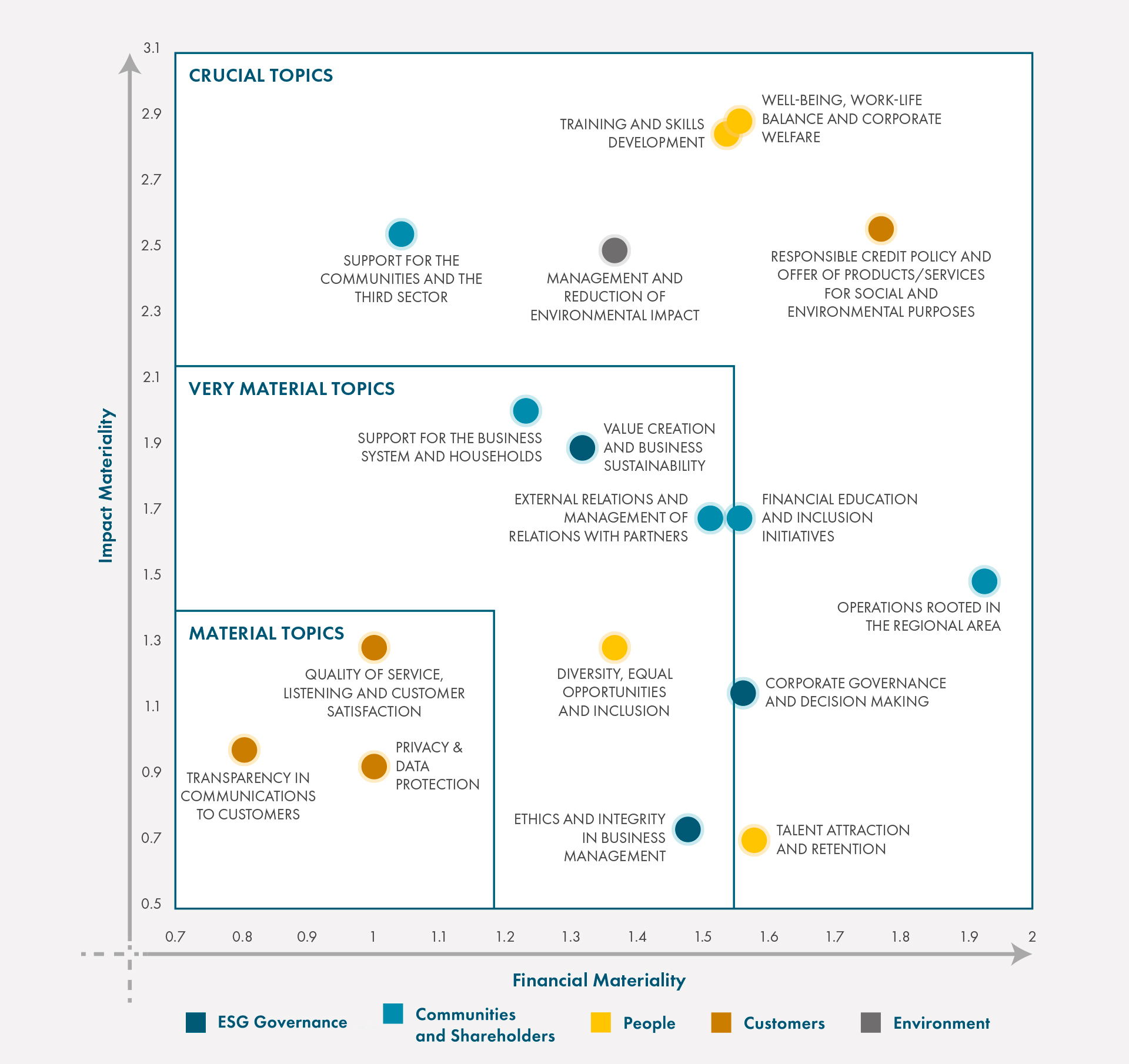

- identifying the correct application of standards and methods to prepare the Consolidated Non-Financial Statement and update the materiality matrix;

- correctly implementing the socio-environmental impact measurement models for the Group and each Associated Bank, functional to convey both sustainability and identity characteristics;

- monitoring national and international initiatives as well as sector trends on sustainability and participation in these initiatives in order to consolidate the company's reputation;

- monitoring the progress of the activities performed by the ESG control function and the Company departments, with reference to the start and development of operational projects of a sustainability nature.

2023 Consolidated Non-Financial Statement

We are 12,000 people who want to improve the service provided to each Customer, with the aim of finding together the most suitable solutions and to disseminate the economic culture in our local Communities.

2024-2027 Sustainability Plan

The 2024-2027 Sustainability Plan gives us the opportunity to enhance, affirm and emphasize what it means to be a Cooperative Banking Group, preserving and improving our attention to the local territory that has always set us apart.

The ESG Portal of the Gruppo Cassa Centrale

Discover how your Bank can support you in the challenge of the green transition with a series of tailored services and solutions and learn more about the themes and opportunities relating to the ecological transition.

Gruppo Cassa Centrale participates in the United Nations Global Compact and adheres to its principles-based approach for a sustainable global economy.

ESG Risk Rating Morningstar Sustainalytics

In April 2024, Cassa Centrale Banca received an ESG Risk Rating of 17.3 and was assessed by Morningstar Sustainalytics as at low risk of being significantly financially impacted by ESG factors.

*Copyright©2023 Morningstar Sustainalytics. All rights reserved. This section contains information developed by Sustainalytics (www.sustainalytics.com). Such information and data are proprietary of Sustainalytics and/or its third party suppliers (Third Party Data) and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose. Their use is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers.